How do lenders determine how much to lend

To calculate how much you can expect to pay for your total loan get the Upfront Mortgage Insurance rate and add it to the base loan amount. Percentage of Gross Monthly Income.

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

How To Get A Loan From A Bank

Most lenders recommend that your DTI not exceed 43 of your gross income.

. To calculate your maximum monthly debt based on this ratio multiply your gross income by 043. Monthly debt based on the back-end ratio you. Here Are Some of The Common Ways That Mortgage Lenders Determine How Much You Can Borrow.

How Do Lenders Work Out How Much I Can Borrow Based On My Income. Its common for lenders to offer businesses credit based on a multiple of. The majority of lenders demand that you will spend less than 28 percent of your income before taxes on housing and that you will spend no more than 36 percent of your.

In order to determine the value you will. Here Are Some Of The Common Ways That Lenders Determine How Much You Can Borrow. Typically lenders will determine how much you can borrow by multiplying your salary by four and a half.

Percentage Of Gross Monthly Income. EBITDA is an abbreviation for Earnings Before Interest Taxes Depreciation and Amortization. This is also how lenders determine how much theyre willing to lend you.

Take Advantage And Lock In A Great Rate. Ideally your monthly mortgage. Next take the total and multiply it first by 028 and then by 036 or 043 if youre angling for a qualified mortgage.

Many lenders also look at the borrowers personal finances using a term called DTI debt to income ratio which calculates your total monthly income and monthly debt including. Many lenders follow the rule that your. Ad Compare Lenders To Get The Right Online Mortgage Terms Rate For You.

For example if you and your partner have a combined gross. However to fully break down the hard money lender mentality and realize the break-even point here is an example. To calculate your maximum monthly debt based on this ratio multiply your gross income by 043 and divide by.

Lender Mortgage Rates Have Been At Historic Lows. Depending on the lender and the loan program you qualify lender will lend like 80 loan to value LTV or maybe 90 LTV or maybe up to 965 LTV. Most lenders recommend that your DTI not exceed 43 of your gross income.

The determined value of the subject property looking at similar recent. If you want to calculate your max. Mortgage lenders verify borrower income and then compare it to the amount of.

They also look at debt to income ratios. You obtain the Upfront Mortgage. They look at whether your income is stable whether it is increasing or decreasing and how much disposable income you might have.

Lenders typically suggest that your back-end ratio not be more than 43 of your gross income. Your DTI is basically a comparison between what you earn. Mortgage lenders typically decide how much to lend based on the borrowers income as well as the debt-to-income ratio DTI.

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

How To Get A Loan From A Bank

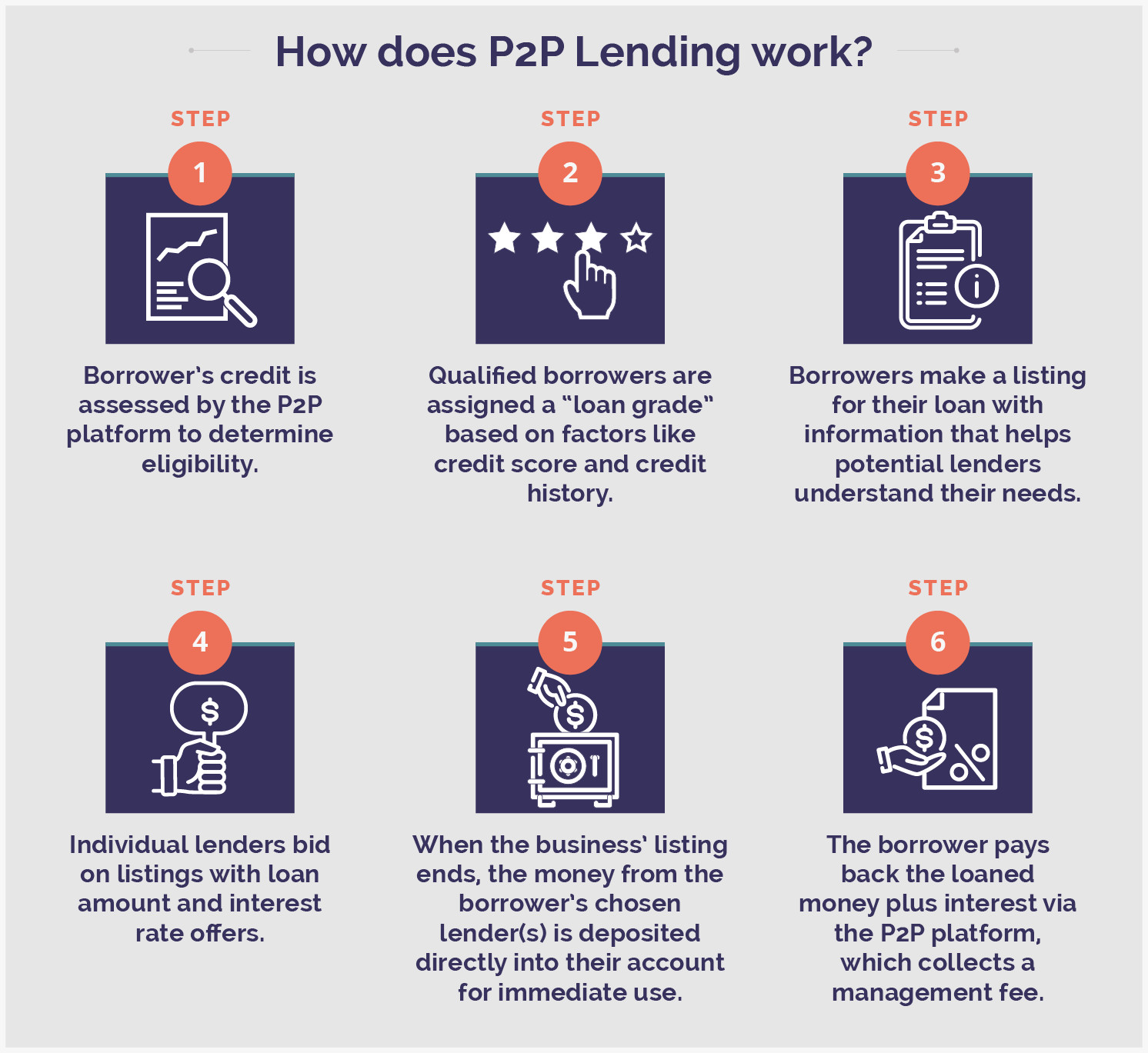

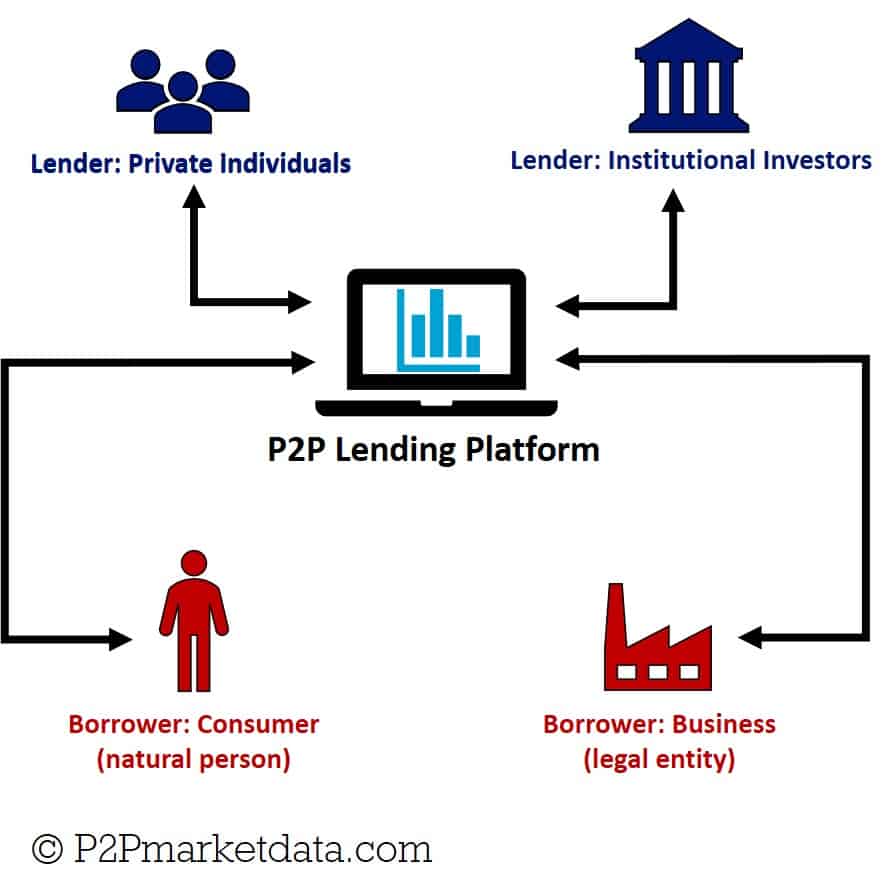

Top Options For Peer To Peer Business Lending Lantern By Sofi

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

What Is Peer To Peer Lending How Does It Work Rbi S Latest Guidelines On P2p Lending Platforms Peer To Peer Lending Peer P2p Lending

What Is Balance Sheet Lending And How Is It Different To P2p Lending

Since 1934 The Federal Housing Administration Has Been Insuring Fha Home Loans In The U S With Competitive Fha Loans First Time Home Buyers Buying First Home

Family Loan Agreements Lending Money To Family Friends

Mortgage Loan Approval Process Explained The 6 Steps To Closing The Hbi Blog Mortgage Loans Mortgage Loan Originator Mortgage Approval

5 Smart Things To Do With Your Refi Savings Smart Things Things To Do Done With You

Applying For Loans Through Direct Lenders How To Apply Lenders Loan

Need A Personal Loan Here S How To Find Loans And Apply

Peer To Peer Lending An Alternative Source Of Finance Peer To Peer Lending Money Management Advice Economics Lessons

Homebuyer Tips When Applying For A Mortgage Mortgage Loans Mortgage Process Refinance Mortgage

Fha Vs Conventional Infograhic Mortgage Loans Home Loans Fha Mortgage

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans

How Much House Can I Afford Buying First Home Home Mortgage Mortgage Marketing